An FHA financing can allow you to get a residence with a credit score as low as 580 and a down payment of 3.5%. With an FHA loan you might be able to purchase a home with a credit history as reduced as 500 if you pay at the very least 10% down. If the rate boosts, it can drastically increase your monthly repayments.

- As soon as you lock in, you're stuck with your rate of interest throughout of your home loan unless you refinance.

- This implies you repay the rate of interest you owe monthly, but not any of the resources you've obtained.

- After that time is over, normally in between five as well as 7 years, your monthly payment enhances as you begin paying your principal.

Obtain what you need, when you need it; little or no closing costs; reduced first rates than typical house equity lendings; interest usually tax-deductable. Can shed residence via repossession if you fail to pay. Rates are greater than on a key lien home mortgage (such as a cash-out refinance). Greater regular monthly repayments than a 30-year finance, reduced rate of interest repayments can influence capacity to itemize reductions on tax returns. The various types of mortgage each have their very own pros and cons.

Residence buyers who want the reduced month-to-month repayment that originates from extending repayment over a long period of time. A 30-year fixed deals https://receive.news/09/09/2020/wesley-financial-group-diversifies-with-the-launch-of-wesley-mutual/ versatility to pay off the car loan quicker by adding to month-to-month settlements. timeshare attorney reviews You can acquire a home with as low as 3% down on a traditional mortgage. You'll additionally need a minimal credit score of at the very least 620 to receive a conventional car loan. You can avoid acquiring exclusive home mortgage insurance if you have a deposit of at the very least 20%.

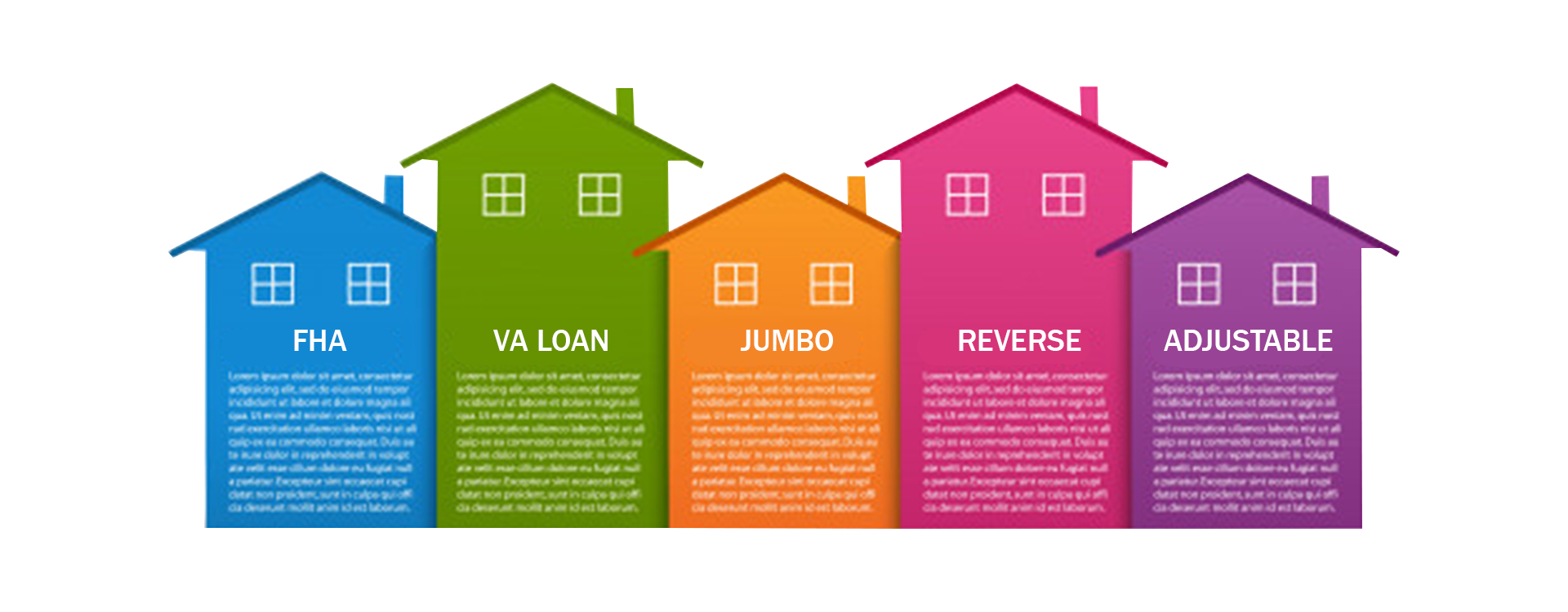

The Various Types Of Mortgages

This variable price home mortgage tracks the Financial institution of England base rate yet prices have a tendency to be more than the base rate. For instance, the base rate is presently 0.1% however a financial institution may charge 2.1%. If the base price raised to 0.25%, the tracker home mortgage price would certainly increase to 2.25%.

How Much Do You Need To Buy A Home? A Cost Malfunction

Yet getting the incorrect home loan could cost you 10s of thousands of dollars as well as decades of financial debt-- in addition to a lifetime of cash battles! If they are currently readily available, a 95% car loan to worth home loan allows newbie customers to add a 5% deposit. If qualified, this suggests you can potentially borrow approximately 95% of your residential or commercial property's value or the purchase rate. Jumbo refers to a home mortgage that's also large for the Federal Federal government to buy or assure.

Obtaining money for any type of purpose desired by the property owner, along with any one of the various other potential uses refinancing. If you believe you might sell your house in much less than five years, it's probably not an excellent suggestion to select a five-year fixed bargain. VA fundings are backed by the Professional's Administration and also are meant for active-duty military participants, reservists, as well as experts. Last on our checklist of the various types of home loan available in the UK is buy-to-let. These home mortgages will certainly typically be tied in with government schemes like Assistance to Purchase. A countered home mortgage permits you to connect your interest-bearing account to your home loan account.